In the dynamic world of digital payments, one prominent Payment Service Provider (PSP) faced a growing challenge: managing the compliance of their extensive network of merchants. Operating in a highly regulated industry, the PSP needed to ensure that every merchant adhered to stringent compliance standards to protect sensitive financial data and maintain regulatory compliance. Enter VendorGuard Service by Rhombes, which revolutionized the PSP’s approach to merchant compliance.

The Compliance Challenge

The PSP had a vast and diverse merchant base, each with unique compliance requirements. The manual processes in place for managing compliance were not only time-consuming but also fraught with risks of human error. The potential for non-compliance posed significant threats, including financial penalties, security breaches, and damage to the PSP’s reputation. Recognizing the critical need for a more efficient and reliable compliance management system, the PSP began exploring solutions that could automate and streamline their processes. This quest led them to VendorGuard Service by Rhombes.

VendorGuard to the Rescue

Requirement Gathering:

The journey started with an in-depth collaboration between the Rhombes team and the PSP to understand their specific compliance needs. Through detailed discussions, Rhombes Team gained insights into the regulatory landscape, internal policies, and the unique challenges the PSP faced.

Platform Configuration:

Armed with this knowledge, Rhombes Platform was mapped to align perfectly with the PSP’s compliance framework. This ensured that the platform could address all relevant standards and requirements for the PSP’s diverse merchant base.

Seamless Merchant Onboarding

Criteria Selection:

The PSP selected compliance criteria tailored to each merchant’s specific industry and role. This targeted approach ensured comprehensive coverage of all necessary compliance aspects.

Onboarding Process:

Merchants were invited to join the Rhombes platform, receiving detailed instructions to guide them through the onboarding process. This step was crucial in ensuring a smooth transition and minimizing disruptions.

Streamlined Data Collection and Verification

Artifact Submission:

Merchants uploaded the required compliance artifacts and evidence directly to the Rhombes platform. This centralized approach made it easier to manage and access critical data.

Verification:

Rhombes auditors rigorously reviewed the submitted artifacts. This process included direct communication with merchants for any needed clarifications or additional information. The PSP’s compliance team was impressed by the thoroughness and efficiency of the verification process.

Continuous Monitoring:

The platform continuously monitored the compliance status of each merchant, tracking any changes or updates in their security posture over time. This proactive approach ensured that the PSP could address potential issues before they escalated.

Proactive Compliance Management

Automated Reminders:

Rhombes Platform automatically sent reminders to merchants to upload the latest compliance artifacts before any lapses could occur. This feature significantly reduced the risk of non-compliance.

Proactive Engagement:

The Rhombes team actively engaged with merchants to ensure timely submission of compliance documents and to address any issues that arose promptly.

Regular Reviews:

Periodic reviews were conducted to ensure ongoing compliance and to identify any potential risks or gaps in the merchants’ security posture. These reviews helped maintain a high standard of compliance across the board.

Comprehensive Reporting and Documentation

Compliance Reports:

Rhombes VendorGuard team generated regular comprehensive reports summarizing the compliance status of all merchants. These reports provided the PSP with valuable insights and highlighted any areas of concern.

Audit Trails:

Detailed audit trails were maintained for all compliance activities, offering transparency and accountability. This feature was particularly useful to understand merchant security poster over time..

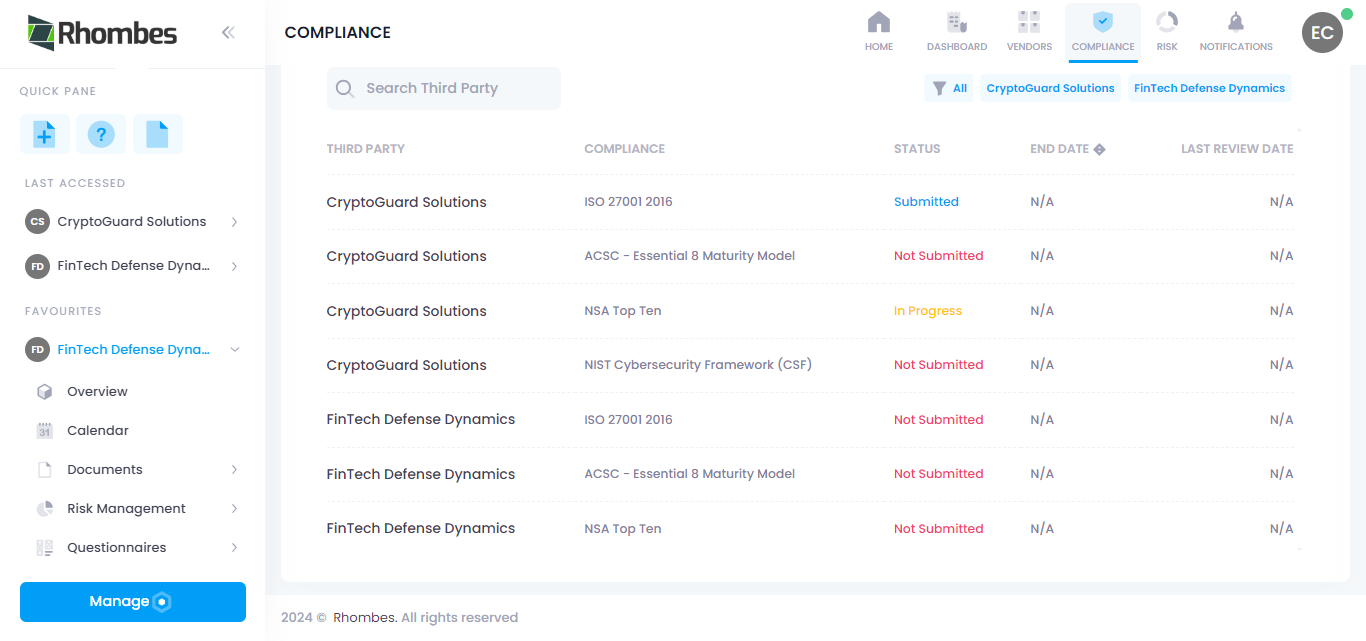

Dashboard Access:

The PSP had access to a real-time dashboard that provided insights into the compliance status of their merchants. This facilitated effective risk management and informed decision-making.

Effective Incident Management

Alerting:

In the event of any compliance issues or potential risks, the Rhombes platform immediately alerted the PSP and VendorGuard Team. This timely notification allowed for swift action and minimized the impact of any issues.

Issue Resolution:

The VendorGuard team worked closely with affected merchants to resolve any compliance issues promptly. This collaborative approach ensured minimal disruption to the PSP’s operations.

Post-Incident Review:

After resolving any incidents, a thorough review was conducted to understand the root cause and to implement measures to prevent future occurrences. This continuous improvement cycle reinforced the PSP’s commitment to compliance and security.

The Transformation

By implementing the Rhombes VendorGuard Service, the PSP successfully transformed its merchant compliance management. The automation and streamlined processes provided by VendorGuard not only enhanced compliance but also freed up valuable resources, allowing the PSP to focus on its core mission: facilitating secure and efficient digital payments.

With VendorGuard, the PSP not only ensured robust compliance but also strengthened its reputation as a secure and reliable service provider in the digital payments industry.